As complicated as the credit card processing industry can be, there are only 3 things you REALLY need to know.

#1 Understand The Rates

There are 500+ tiers of pricing, when you combine all credit/debit card types. It is important to familiarize yourself not only with the pricing but also how the pricing relates to your specific business. Card pricing rates vary based on card type and how the cards are processed. Take some time getting to know both VISA INTERCHANGE and MASTERCARD INTERCHANGE rates. Remember that Interchange is the cost before any markups and before the costs or markups associated with capturing, authorizing and settling each transaction. When you have a great understanding of the various card types and the actual costs, you can make better decisions related to your processing needs.

#2 Know Your Effective Rate & Most Likely Card Types

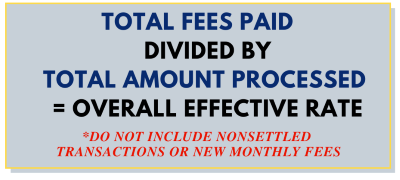

Checking your monthly statement and calculating your overall effective rate can give you a good guideline to quickly verify that your rates are in line.

Identifying any variations in your monthly effective rate can help you make sure your rates are accurate and error free.

The other thing to consider is the average size of the transacion that your business is likely to accept. For example - if your average ticket is less than $100, you are more likely to accept debit cards from your customers which happen to be amongst the lowest priced cards. If, on the other hand, your average ticket is over $250, you are more likely to accept the higher priced rewards cards. Knowing this kind of information can really help you keep an educated eye on your monthly fees.

#3 Be Sure You Have a Worthy Partner/Processor

The importance of having a strong partner to handle your processing needs cannot be overstated. After all, you will be providing a ton of personal and sensitive business information in order to get your merchant account up and running and a strong partner can grow with you as your business progresses. Here are the top 5 attributes of a great processor:

- Integrity: Having a processor that will guide you to using the RIGHT processing solution regardless of their financial gain is very important. As your business grows, your needs will change so being able to count on integrity based information is very important.

- Knowledge/Expertise: With the complex pricing structure and the various ways to accept credit cards, having a trusted professional who keeps up with the everchanging world of credit card processing is also important.

- Exceptional Service: Most of the time, credit card processing equipment works fairly semlessly but when you have a challenge or a service need, you have to be be able to count on the promises of excellent service. It is one thing to make those promises and another thing entirely to actually deliver. Check references and consider how you heard about the company; in most cases, a strong referral means exceptional service.

- Competitive Rates: Now that you know how to find the hard cost of processing and estimate your overall monthly effective rate, your selected processor should be providing you with competitive rates and transparency in the fee structure. All companies are in business to make a profit but a worthy processor will provide you with rates that are competitive.

- Partnership Mentality: A TRUE salesman is a professional who truly cares about the people they serve. A Partnership Mentality with your processor will insure that you get the very best combination of both pricing and service!

When you know the basics of the credit card processing industry and align yourself with a strong partner, you bypass all of the pitfalls and negative issues associated with credit card processing and you are free to focus on the things that will truly make your business grow.